non filing of income tax return notice reply

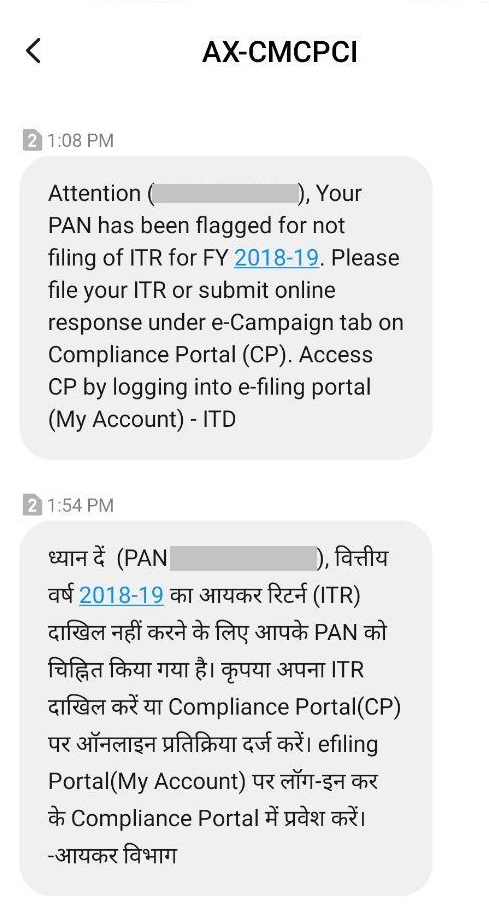

If you have not filed your income tax return in any of the previous 6 tax assessment years you could be sent a notice for delay or non-filing of income tax returns. In most of the cases the income tax department sends out income tax notice via mobile SMS or electronic mails.

How To Reply Notice For Non Filing Of Income Tax Return

Yes You can either file the return as a fresh revised return incase the time provided for filing the return in a particular assessment year has not lapsed or alternatively you can also choose to respond to Notice us139.

. Click on the Compliance Tab and. In case if you have already filed income tax return but not declared correct tax liability pay due taxes and file revised return. When is a Compliance Notice Issued by the Income Tax Department.

Willful failure to furnish return of income under section 1391 or in response to notice under section 1421i or section 148 or section 153A non-cognizable offence under section 279A can result into prosecution as under. However once the time provided for filing the return for a particular assessment year has lapsed you will not be able file the return as a fresh revised return and. Click on Compliance Menu Tab and you will be re-directed to the Compliance portal.

Login to your Income Tax Department website account. Notice for Non-Disclosure of Income. The issue of a notice under section 148 of the Income-tax Act the Act calling upon the Taxpayer to file a return of income for the year specified in the notice is the starting point of the Re-assessment Re-audit proceedings.

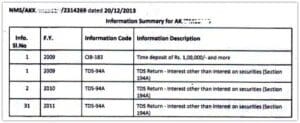

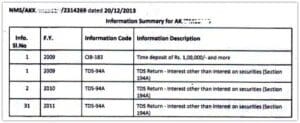

It can happen that you missed filing your return while your employer has deducted the tax. You are only required to reply to the govt the reason why you didnt file your ITR. Non-filers of ITR with potential tax liabilities are identified by analysing information received under Annual Information Return AIR Statement of Financial Transactions SFT Centralised Information Branch CIB.

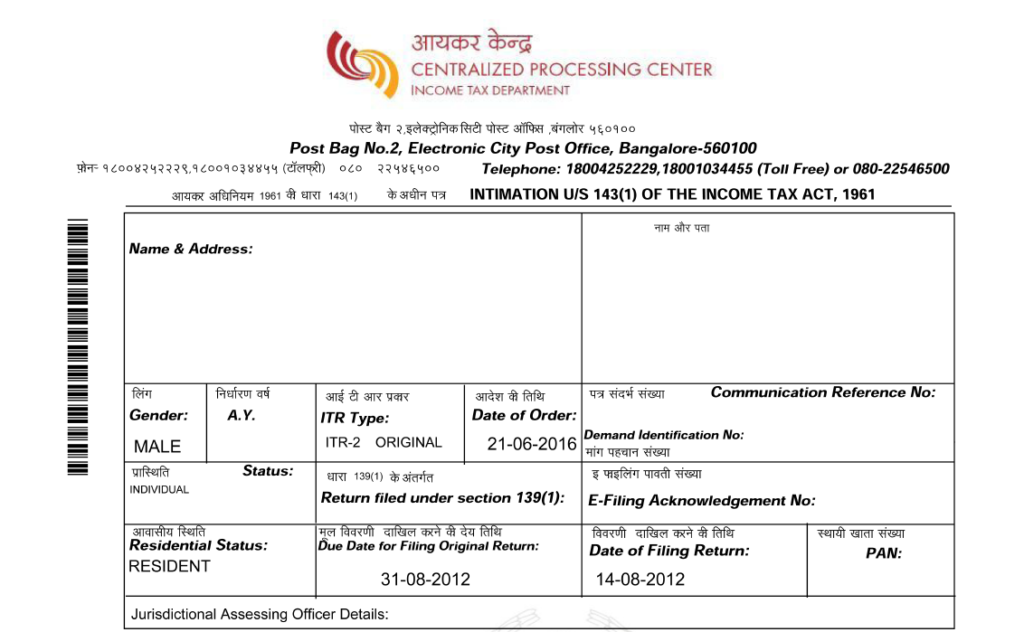

It may be noted that income tax authorities are empowered us 148 to reopen the case of assessment for earlier years us 148. If you have not filed the Income Tax Return by July 31 you will get a notice on non-filing of ITR. Process How to respond Notice NoN return filing of Income Tax.

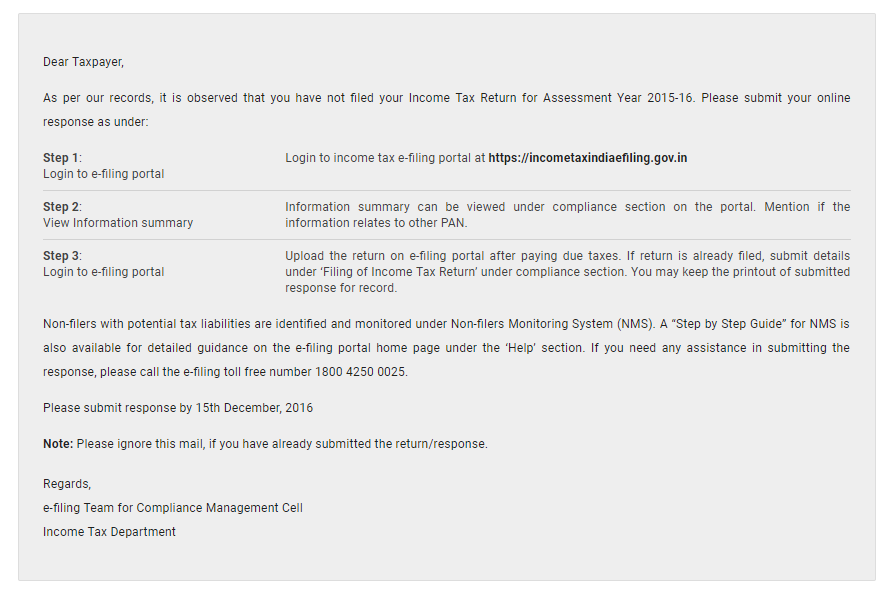

Responding to the Notice for Non-Filing of Return. Delay or Non-Filing of Income Tax Return. Click on respective Financial Year under the e-Campaign Response on filing of Income Tax Return as shown above to submit the response.

And sending correspondence to the IRS via mail could further compound the mail backlog. In both these scenarios you will be sent a notice asking you to file returns within the. Here you can view information.

Login to your account on the website incometaxindiaefilinggovin. It is also possible that you get filed your returns after the due date. You reply non filing of income tax return notice is.

If you have filed the returns and the taxman has made a mistake then you could simply send them the Income Tax Return Verification ITR-V acknowledgmentreceipt from. And go to compliance Tab after login. Following are some of the main reasons why you might receive a notice from the Income tax Department.

A Re-assessment proceeding also referred as re-opening of the assessment is initiated by the. In case you are not liable to file return submit online response under Response on non-filing of return on Compliance Portal. Now Go to E- Campaign tab a notification will come under Non- filing of return.

Click on Compliance Menu Tab and you will be re-directed to the Compliance portal. File your ITR as soon as possible and attach the ITR-V or reply with Return under preparation. You can reply to such a notice by following these steps-.

Interest is not calculated with respect to the extension of payment deadlines and the suspension of tax debt collection. Login to your e-Filing account at incometaxindiaefilinggovin with your user name and password. Responding to the Notice for Non-Filing of Return In most of the cases the income tax department sends out income tax notice via mobile SMS or electronic mails.

Returns Not Filed It can happen that you missed filing your return while your employer has deducted the tax. If you do not have a. It will redirect to compliance portal.

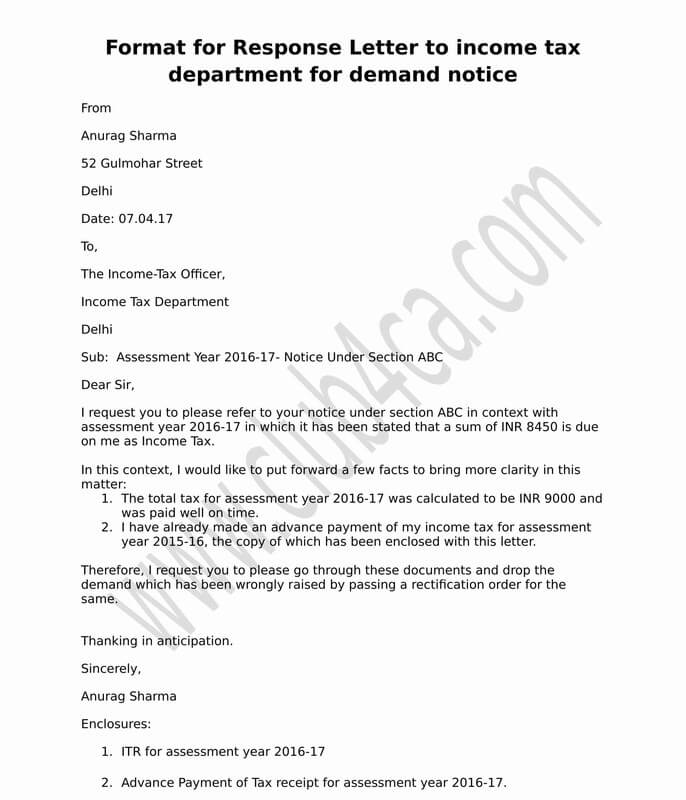

If Information is correct file income tax return after paying due taxes and. There are various taxpayers who have received notices us 148 asking taxpayers to furnish the return us 148. If you did not file ITR because your income was below the taxable limit then mention this in the letter.

Now under Compliance tab Select Compliance portal option and click on Confirm button. If this was just relating to 14 lakh and you havent earned any income in India you can simply reply against the compliance notice that you were not required to file the return as you were NRI and not required to file Income tax return. It is a normal.

You could get this notice within a year of the end of the assessment year for which return has not been filed. Further the period of reopening of assessment has been reduced to 3 years in normal. Where tax sought to be evaded exceeds Rs 1 lakh 6 months to 7 years Rs 25 lakh wef.

How to response to Notice under Section 148. The Income Tax Department has installed a Non-Files Monitoring System NMS. Click on View to submit your response to the.

You can respond to the notice of non-filing of returns via online channel by logging in to the income tax departments e. Login to httpsincometaxindiaefilinggovin The Income Tax Department has created a module in its interface called Compliance to respond such notices. If you have received a mail from the Income Tax Department by post then you need to reply to the authority that sent the notice giving detailed reasons for not filing the ITR.

How To Respond To Non Filing Of Income Tax Return Notice

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

How To Respond To Non Filing Of Income Tax Return Notice

How To Reply Notice For Non Filing Of Income Tax Return

How To Reply Notice For Non Filing Of Income Tax Return

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

How Should You Respond To A Defective Income Tax Return Notice Under 139 9

How To Respond To Non Filing Of It Return Notice Learn By Quickolearn By Quicko

Letter Format To Income Tax Department For Demand Notice

How To Respond To Non Filing Of Income Tax Return Notice

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Respond To Non Filing Of Income Tax Return Notice

Understand Income Tax Notices Learn By Quickolearn By Quicko

How To Reply Notice For Non Filing Of Income Tax Return

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko